Setting Up a Deduction

Setup Deduction Entities

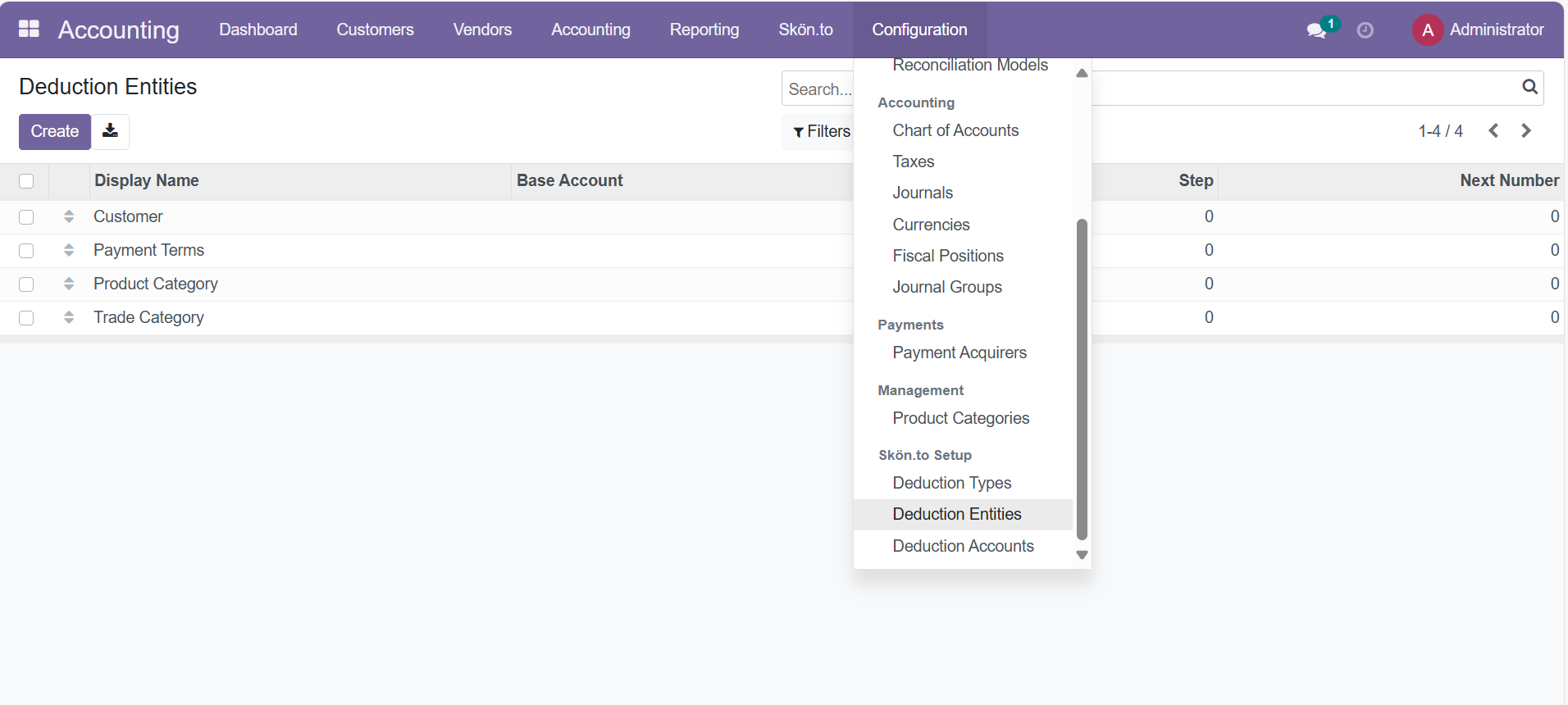

Step 1

Setup Deduction Entities Navigation:

Accounting → Configuration → Skon.to Setup → Deduction Entities

Begin by setting up Deduction Entities, which represent the base objects for deduction calculation (such as customer, payment terms, product category or trade category).

Differences between Deduction Entity Types:

- Customer: Use when rules vary by individual client.

- Payment Terms: Use when rules are linked to invoice or contract payment conditions.

- Product Category: Use when deduction rules depend on what is being sold.

- Trade Category: Use when deduction is based on broader sector or trade segmentation.

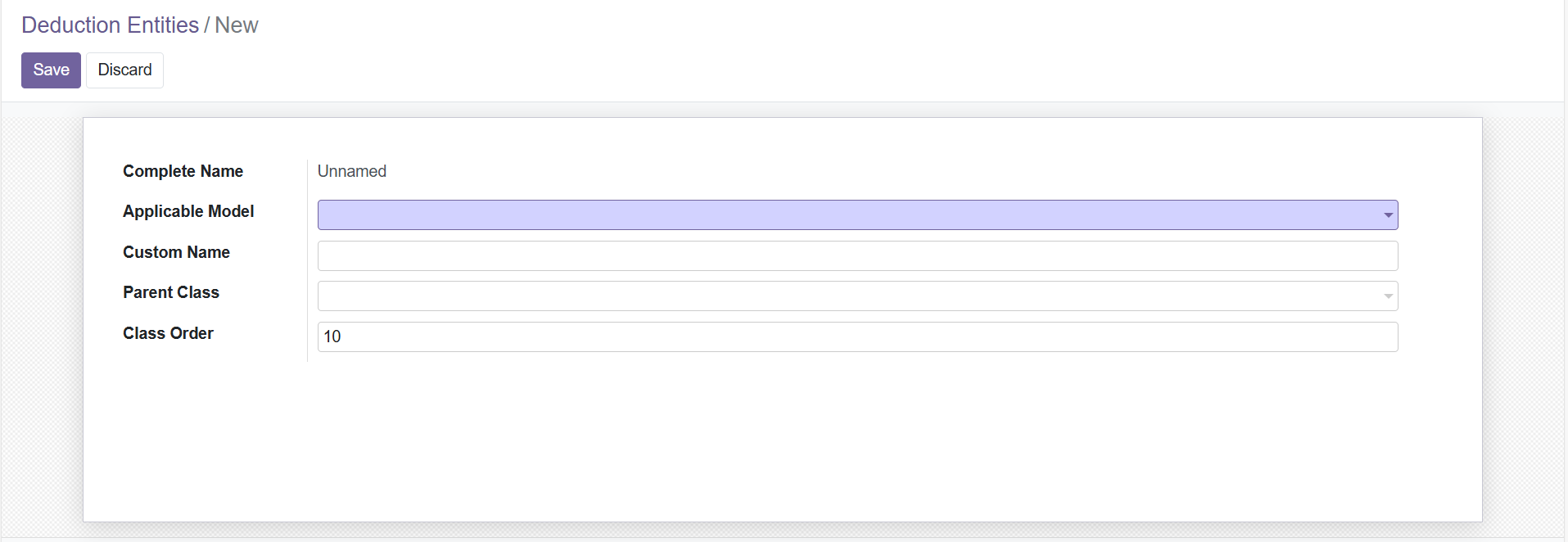

Process of Creating a Deduction Entity:

To create a new Deduction Entity:

- Click the “Create” button.

- In the form that appears, you must select the appropriate Applicable Model from the drop-down list

- Fill in the required fields and configure deduction details according to the chosen entity type.

Accurate definition of entities ensures that deductions are assigned to the correct database. Proper setup at this stage is foundational to maintaining calculation accuracy and traceability throughout the deduction process.

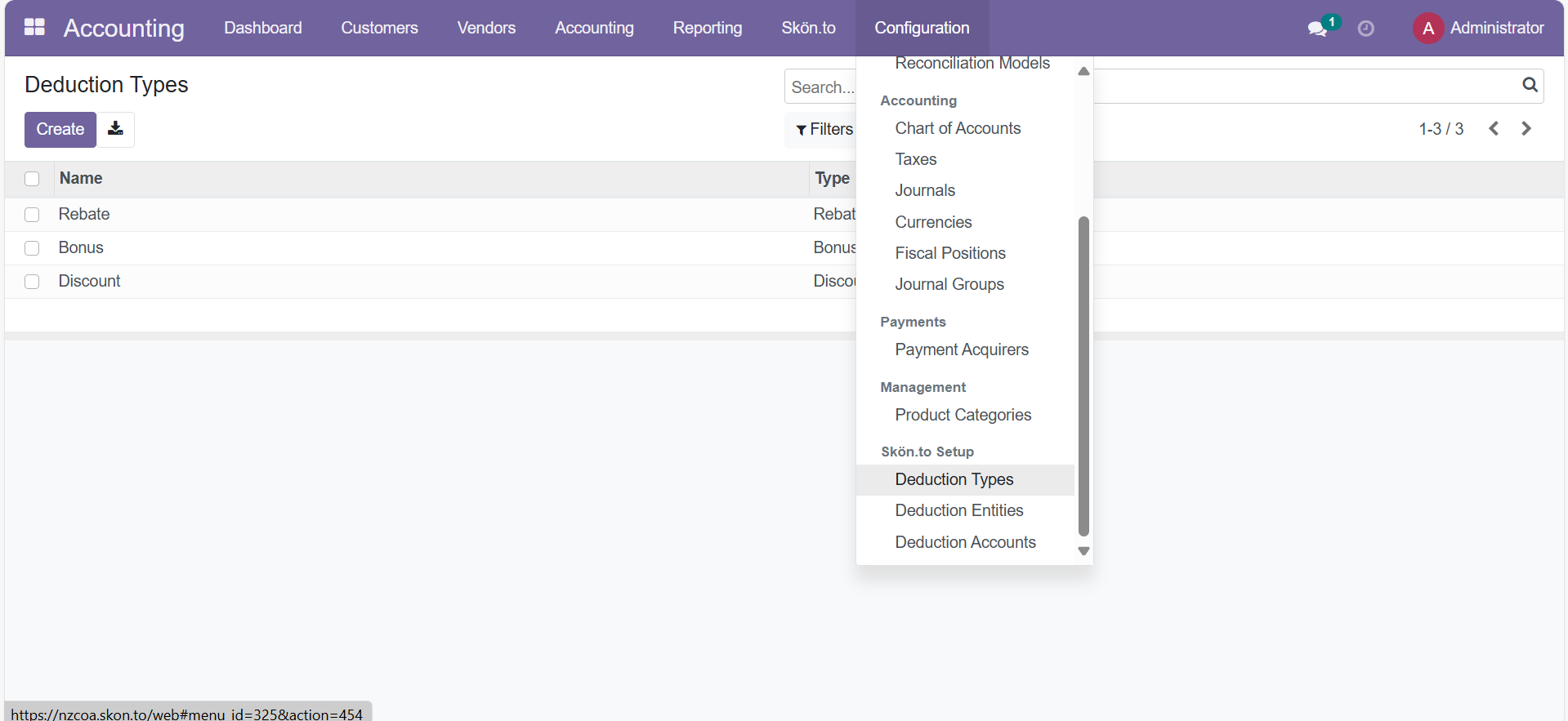

Setup Deduction Types

Step 2

Configure Deduction Types Navigation:

Accounting → Configuration → Skon.to Setup → Deduction Types

The main Deduction Types you can set up are:

- Rebate is a portion of the sales cost that is returned to the customer after the transaction is completed and payment has been received. Rebates function as a sales incentive and are intended to foster customer loyalty.

- Discount is a price reduction offered before the sale is completed. Customers pay a lower price right at the time of purchase.

- Bonus is an additional incentive or reward given to a customer, often for reaching sales targets, purchasing certain volumes, or as a form of recognition.

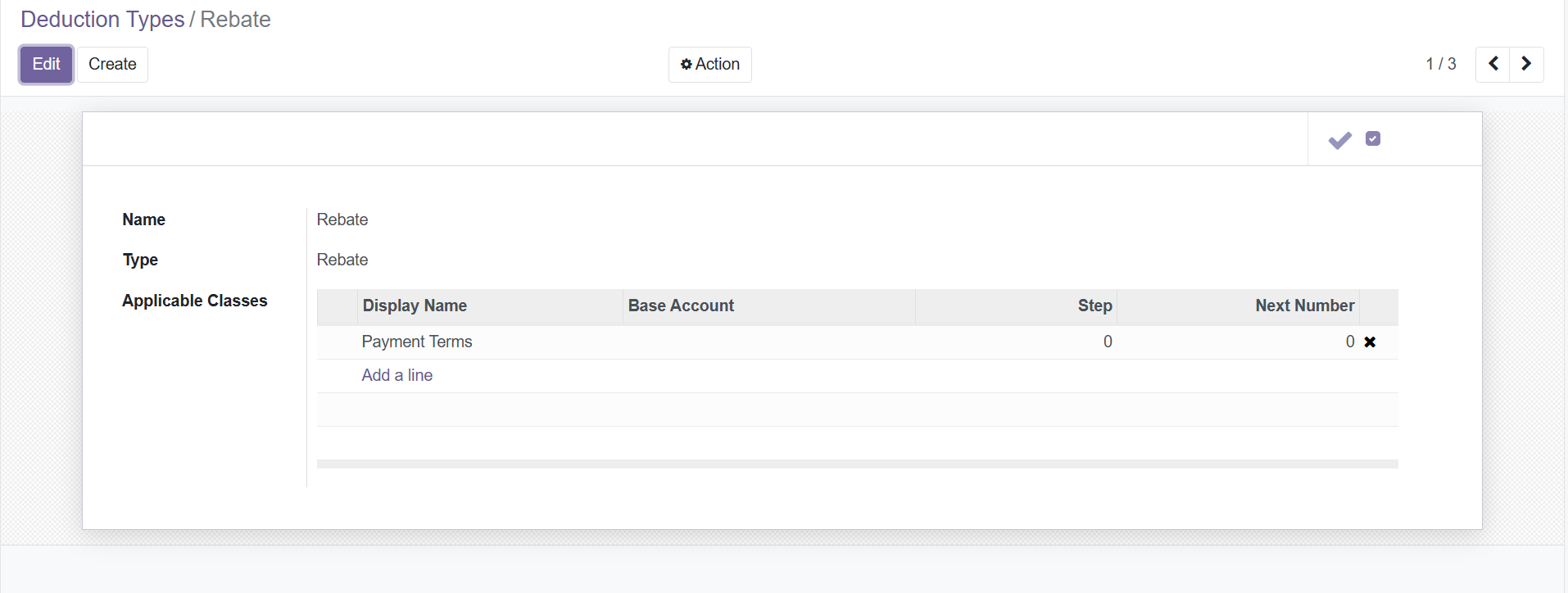

Fields to Complete When Creating a Deduction Type:

- Name: The name of the deduction type you are creating (e.g., End of Year Rebate, Seasonal Discount, Loyalty Bonus).

- Type: Select the deduction type from the available options (Rebate, Bonus, Budget, etc.). You can only select one type per record.

- Applicable Class: Choose one or more classes (deduction entities) this type will apply to. Classes refer to entities set up in Step 1.

Setup Chart of Account for Deduction Definition

Step 3

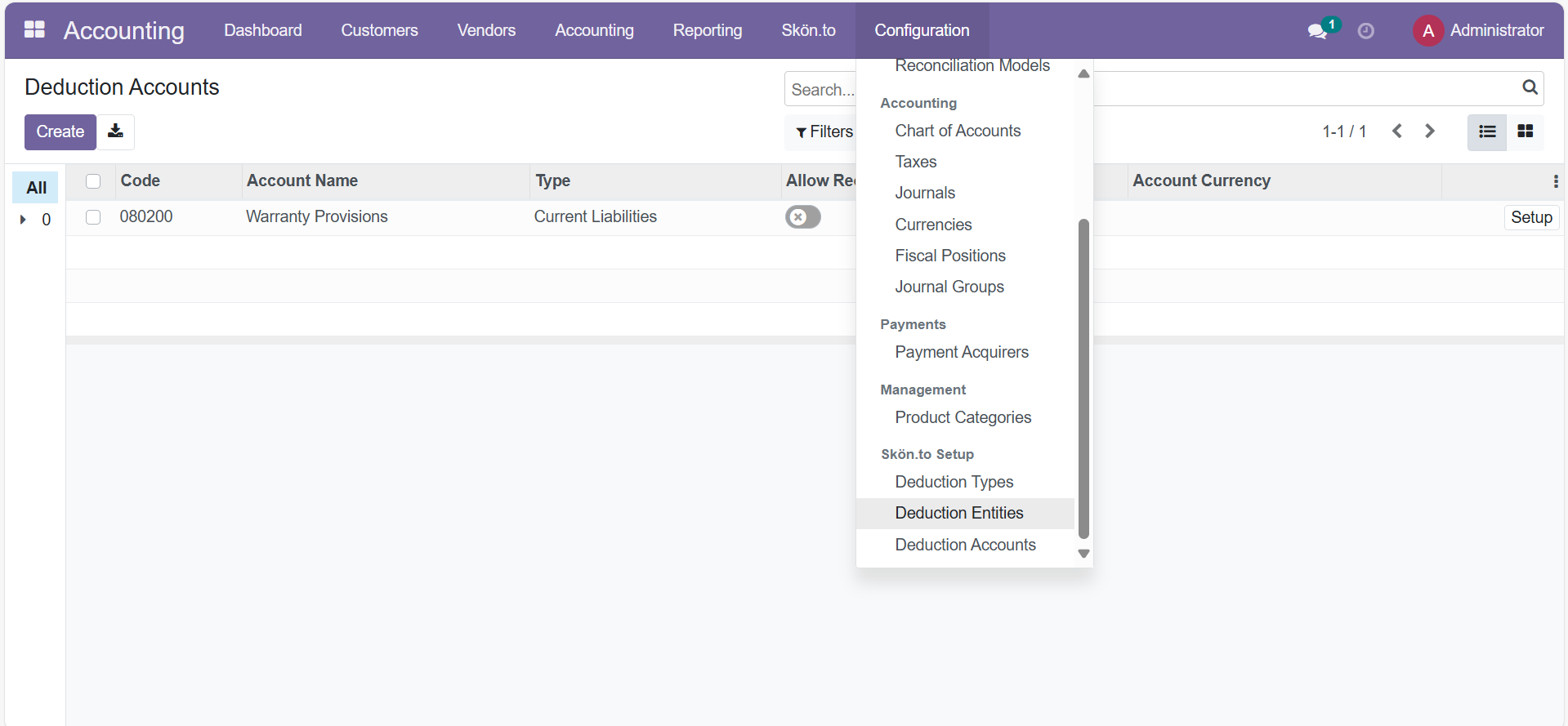

Define Chart of Accounts for Deductions Navigation:

Accounting → Configuration → Skon.to Setup→ Chart of Accounts

It is recommended to create dedicated accounts for recognizing deductions separately from core sales or cost accounts. This segregation enables transparent financial tracking and accurate reporting of deductions, supporting compliance and audit requirements.

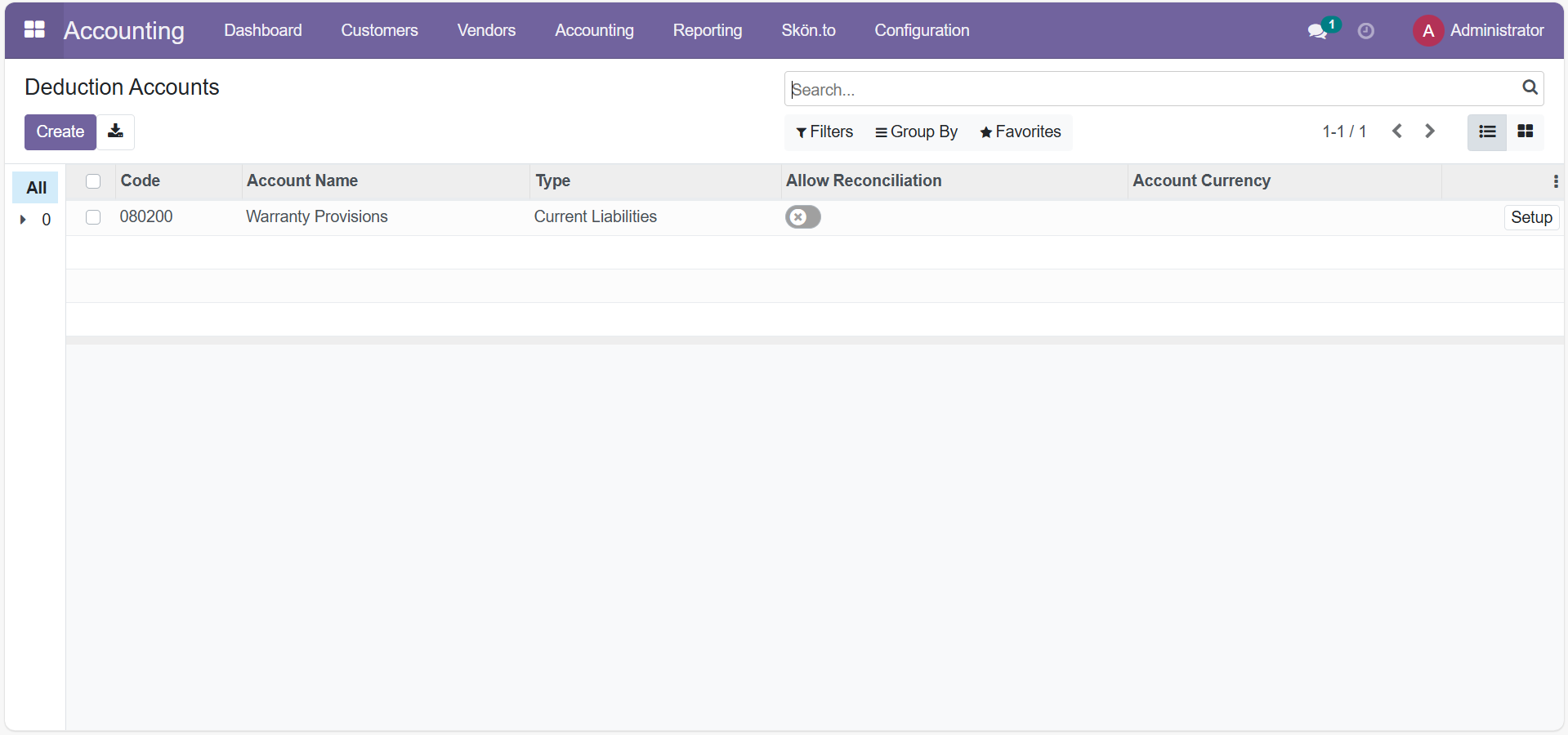

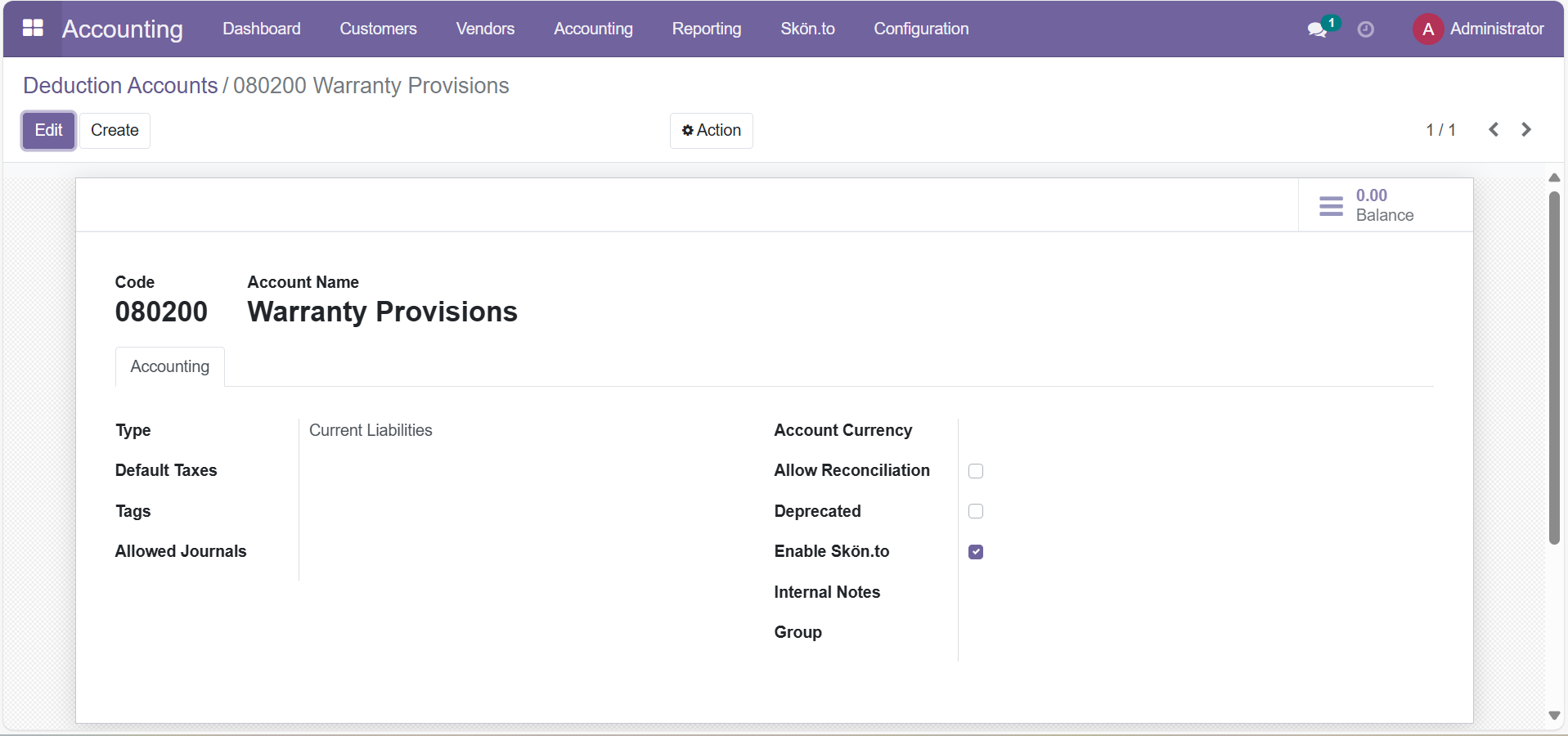

To create a new Deduction Accounts:

- Click the "Create" button.

- Fill in the fields: – Code: Enter a unique code for the account; – Account Name: Specify the name of the account (for example, Warranty Provisions); – Type: Select the appropriate account type from the available options (such as Current Assets, Current Liabilities, Income, or Expenses).

- Click the "Setup" button. After filling in the required fields, click on the Setup button to configure additional options for the account.

Setup Deduction Definition

Step 4

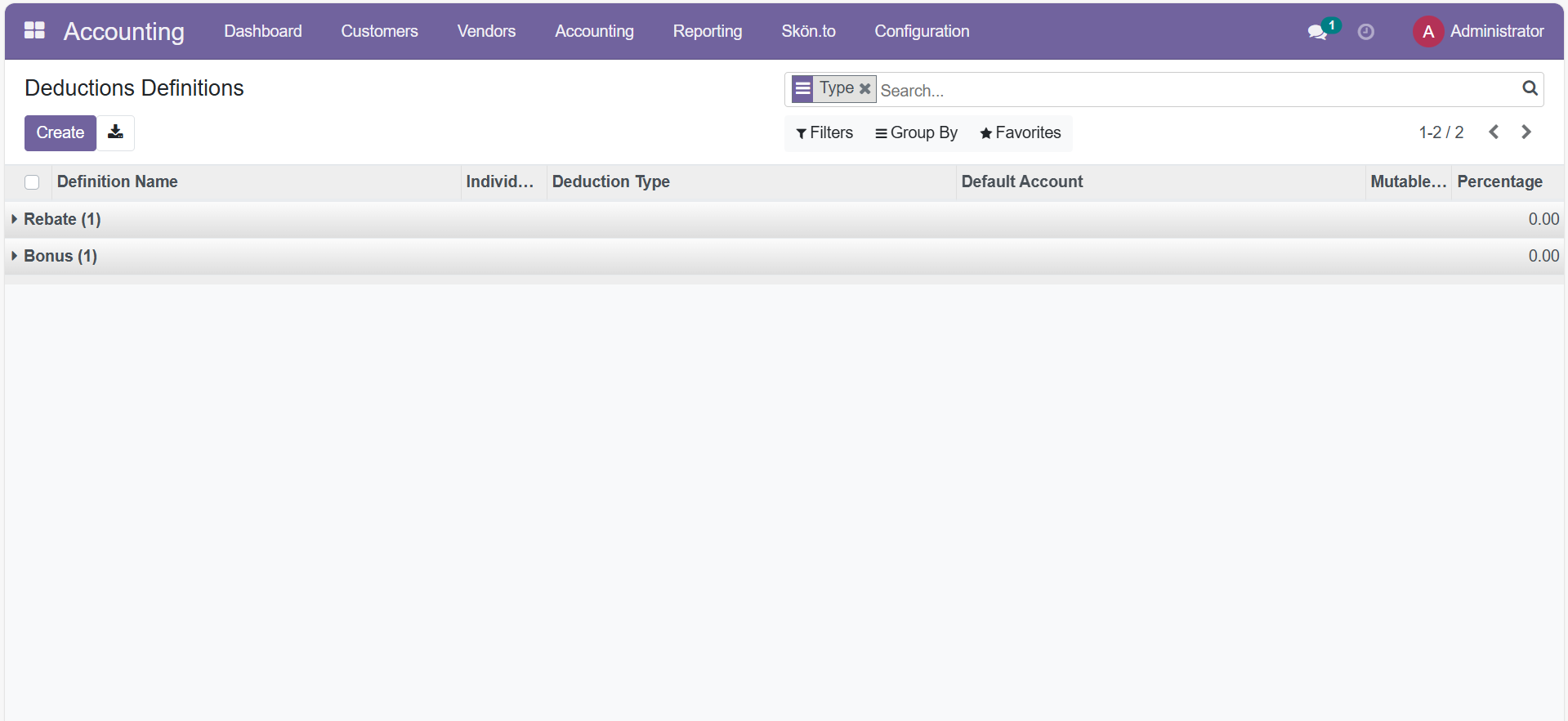

Create Deduction Definitions Navigation:

Accounting → Skon.to → Deductions → Deduction Definitions

Set up how specific deduction types are to be applied by creating a Deduction Definition. Follow these steps:

- Click the "Create" button

- Write a Description

- Set the Class – Choose a Class from the drop-down list. The class determines the entity type (defined in Step 1). Multiple classes can be selected.

- Select the Default Account – Choose the Default Account (created in Step 3) in which the deduction transactions will be recorded.

- Select Deduction Type – Choose the Deduction Type (defined in Step 2) from the drop-down list to specify whether this definition applies to a Rebate, Discount, Bonus, etc.

- Click on the "Mutable Deduction" checkbox

- Choose a Deduction Rule – Select a Deduction Rule from the list. This rule defines how the deduction is to be calculated when there are multiple possible percentages at different levels of the entity hierarchy.

Deduction Rule Options Explained:

The Deduction Rule field determines how to apply deductions when there are several applicable percentages configured at various entity levels. The available options are:

- Max: Apply the maximum percentage among all percentages defined at the Deduction Definition level (for the selected class/entity).

- Minimum: Apply the minimum percentage among all percentages defined at the Deduction Definition level.

- Sum: Sum all the percentages configured at each entity level within the Deduction Definition and apply the total.

- Lowest Entity Level: Apply the percentage at the closest (lowest) entity level in the hierarchy. For Customers, the Branch level may take priority over the Parent Company level.

- Highest Entity Level: Apply the percentage at the highest entity level in the hierarchy. For example, Parent Company rather than Branch.

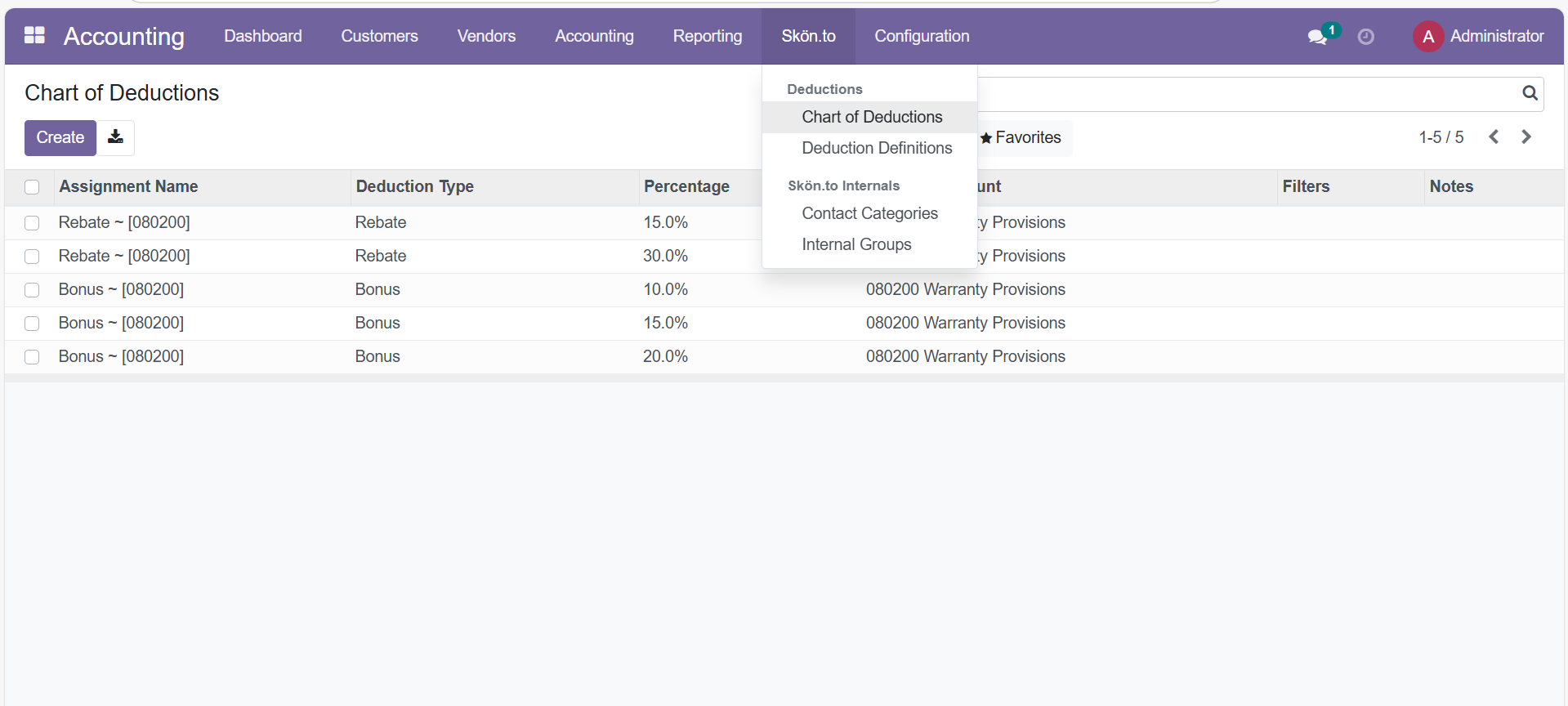

Setup Chart of Deductions

Step 5

Setup Chart of Deductions Navigation:

Accounting → Skon.to → Deductions → Chart of Deductions

Configure the Chart of Deductions by assigning specific deduction definitions to relevant entities (such as product, product category, customer etc). This mapping ensures that the correct deduction rules apply automatically in operational transactions.

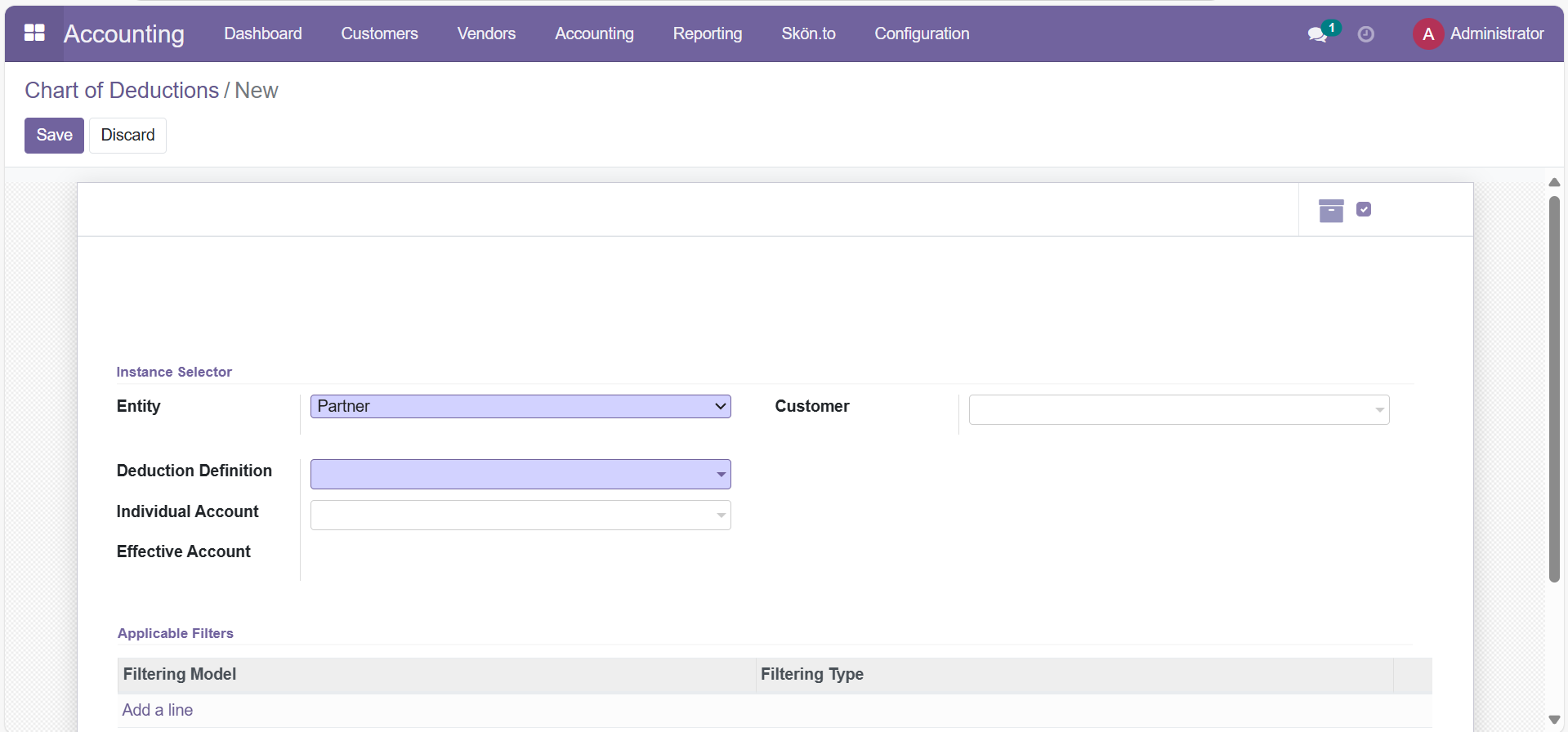

To set up the specific deduction percentage for each entity, follow these steps:

- Click the "Create" button;

- Select the Entity from the list. Choose the relevant Entity (such as Product Category, Customer, Payment Terms, etc.) from the drop-down list.

Depending on your choice, a specific field will appear:

- If you select Product Category, you need to specify the exact product category to which the deduction will apply.

- If you select Parent, you need to select a specific Customer (Parent Entity) for the deduction.

- Select the Deduction Definition. Choose the appropriate Deduction Definition you have previously created. After selecting, the fields Effective Account and Type will be filled in automatically based on the Deduction Definition settings.

- Enter the Individual Percentage. Specify the Percentage value (e.g. 10%) that will be applied for this particular entity level.

Detailed Explanation of Deduction Rules

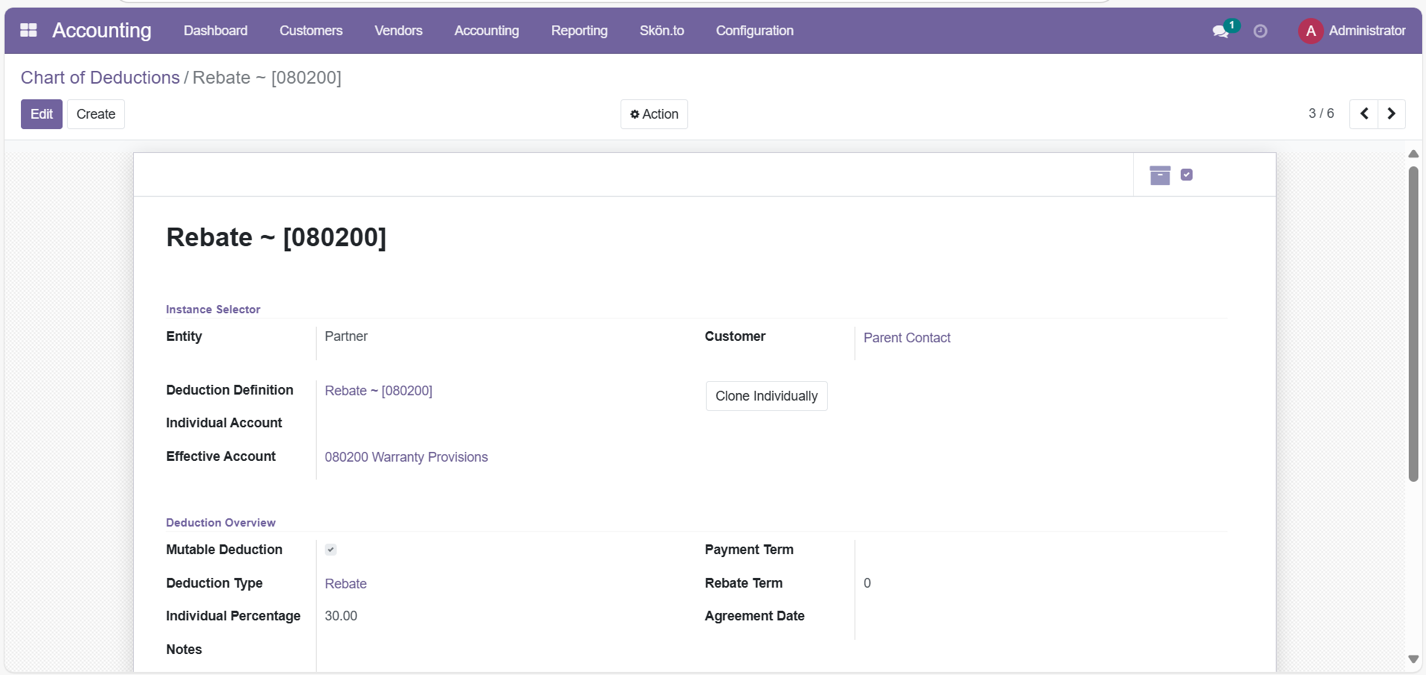

Highest Entity Level

When the Highest Entity Level rule is selected in the Deduction Definition, the deduction percentage is applied from the line in the Chart of Deductions where the percentage is set for the parent company in the hierarchy.

Example:

- In the Deduction Definition, the rule is set to "Highest Entity Level."

- The Chart of Deductions contains two entries:

30% for the Parent company;

15% for the Branch;

- When creating a Sales Order, regardless of whether the Parent or Branch company is selected in the entity hierarchy, the deduction percentage that will be applied is 30% (the value set for the Parent company).

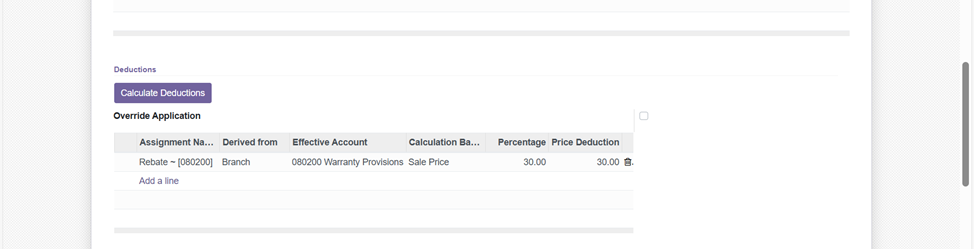

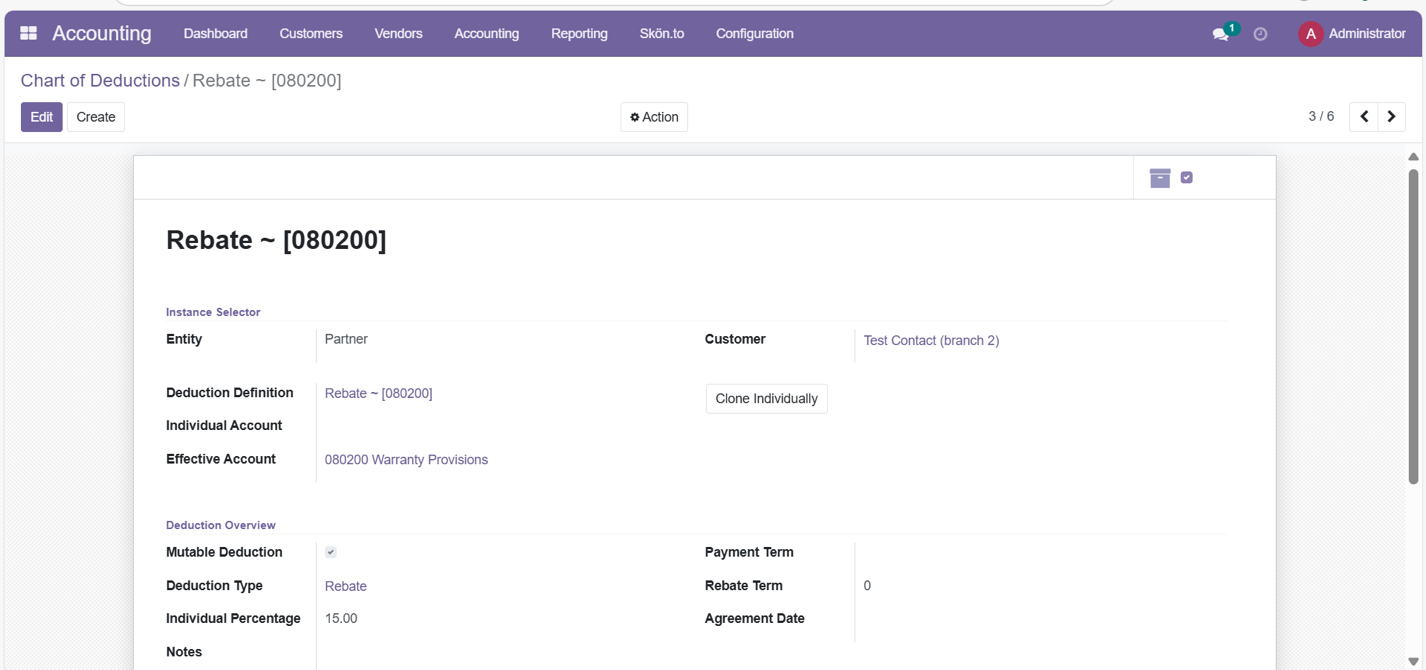

Figure 1. A 30% deduction percentage defined for the Parent company in the Chart of Deductions.

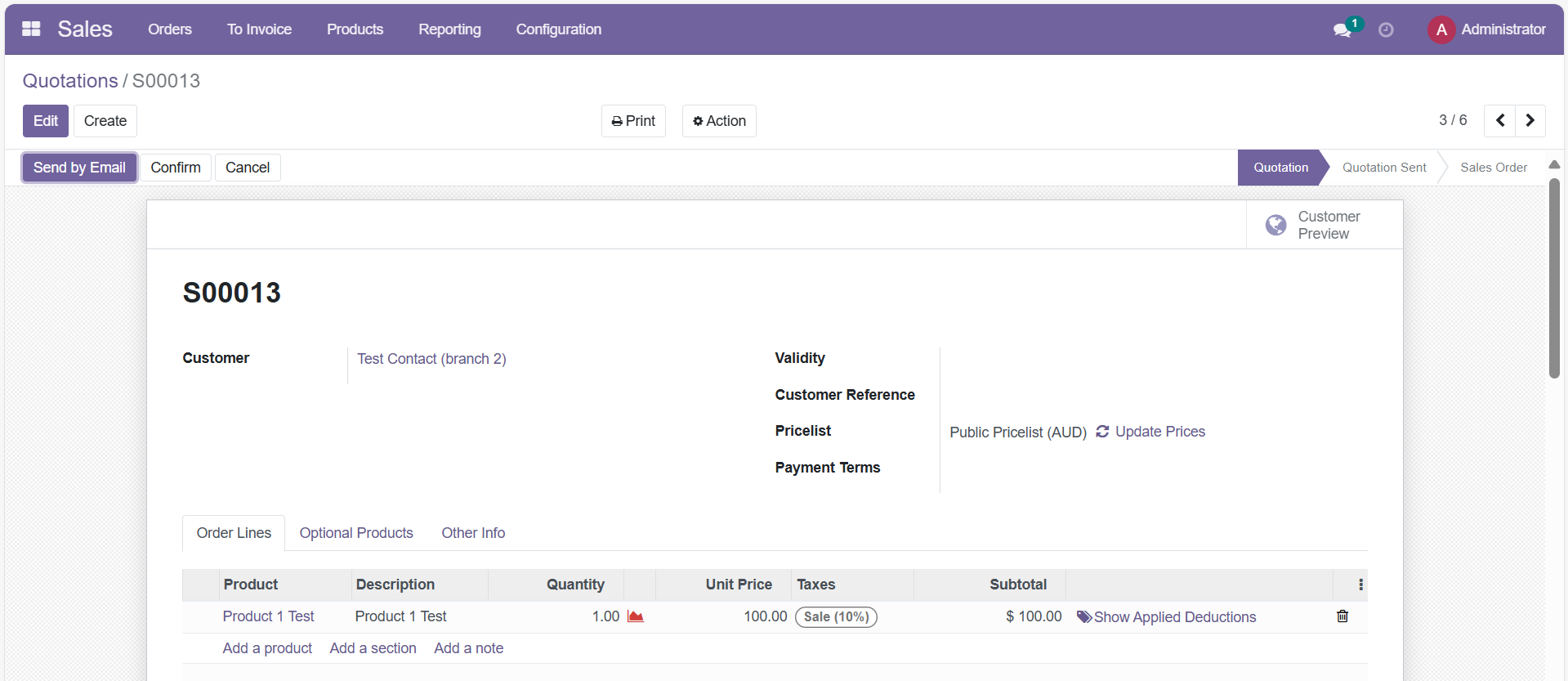

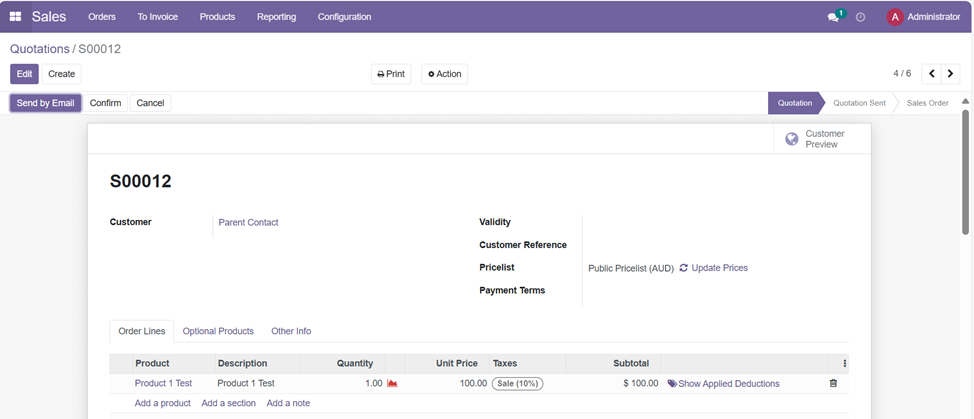

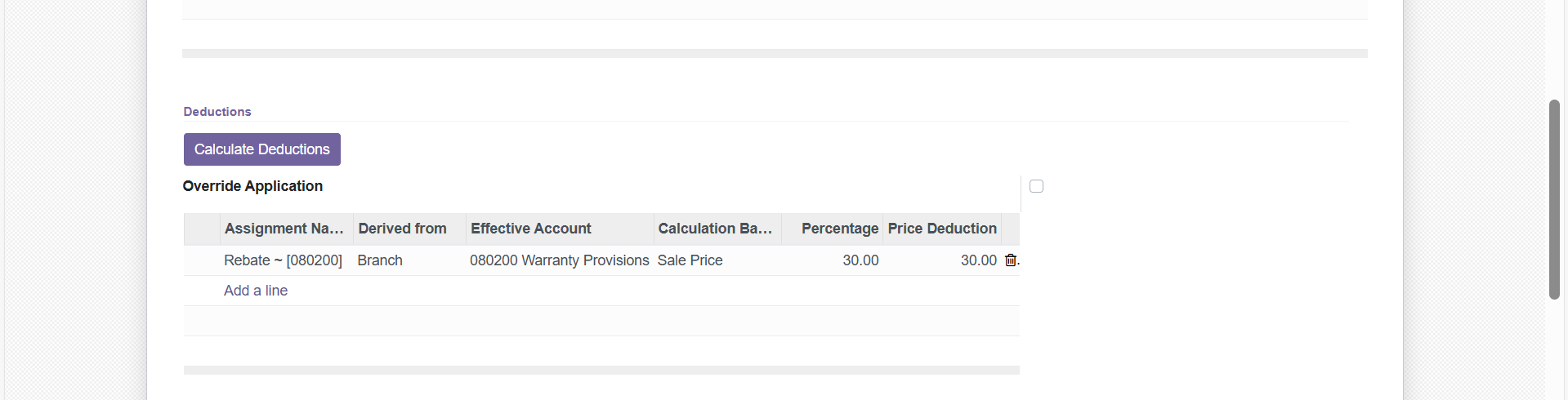

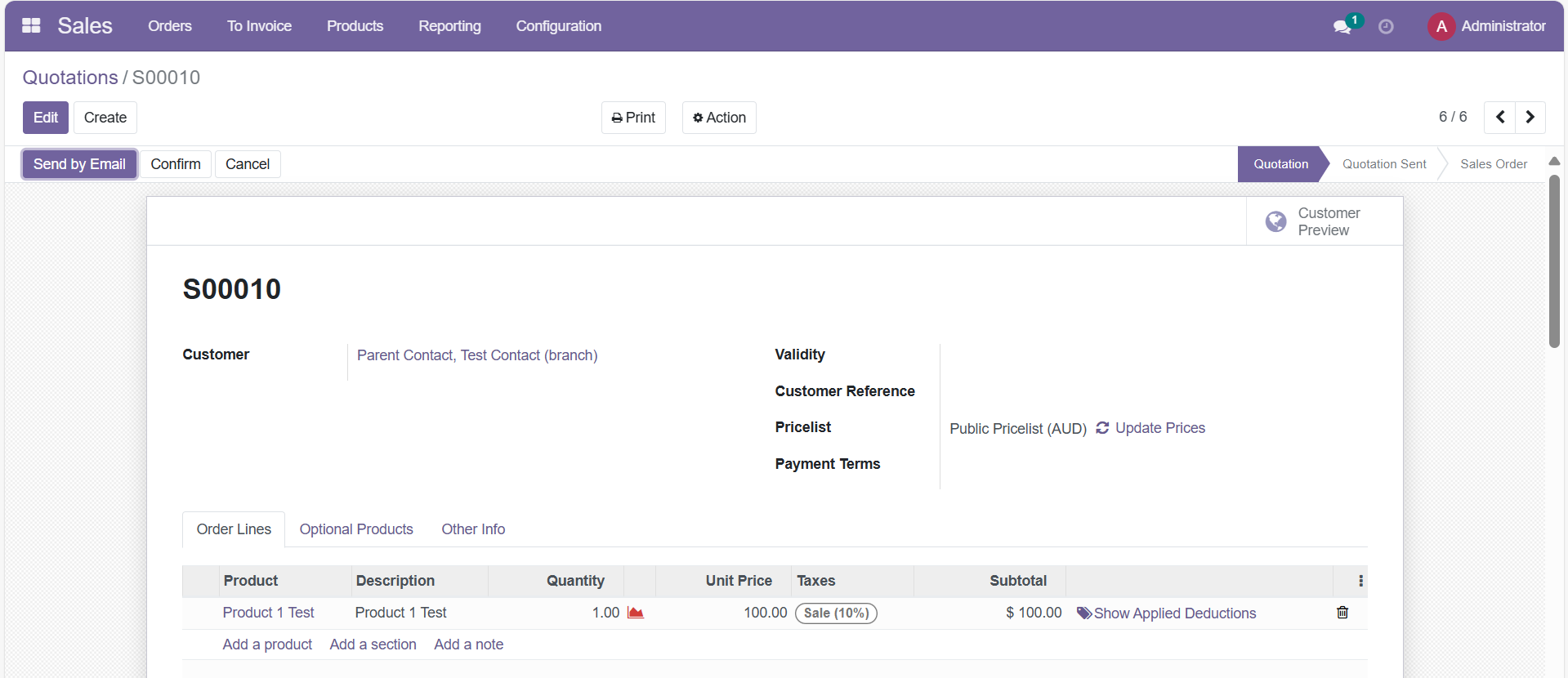

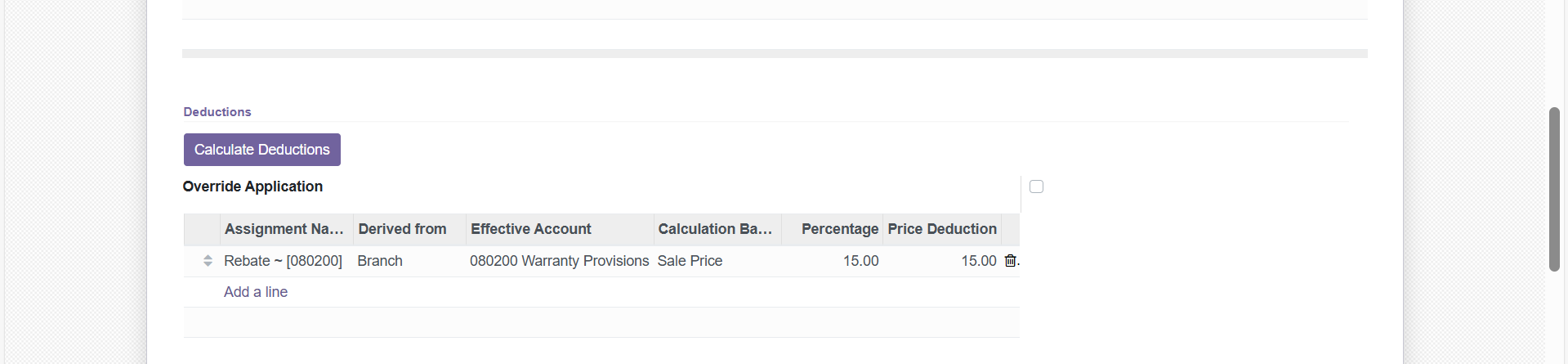

Figure 2. Invoice with the Branch company as customer; the deduction percentage is still 30% according to the "Highest Entity Level" rule.

Figure 3.

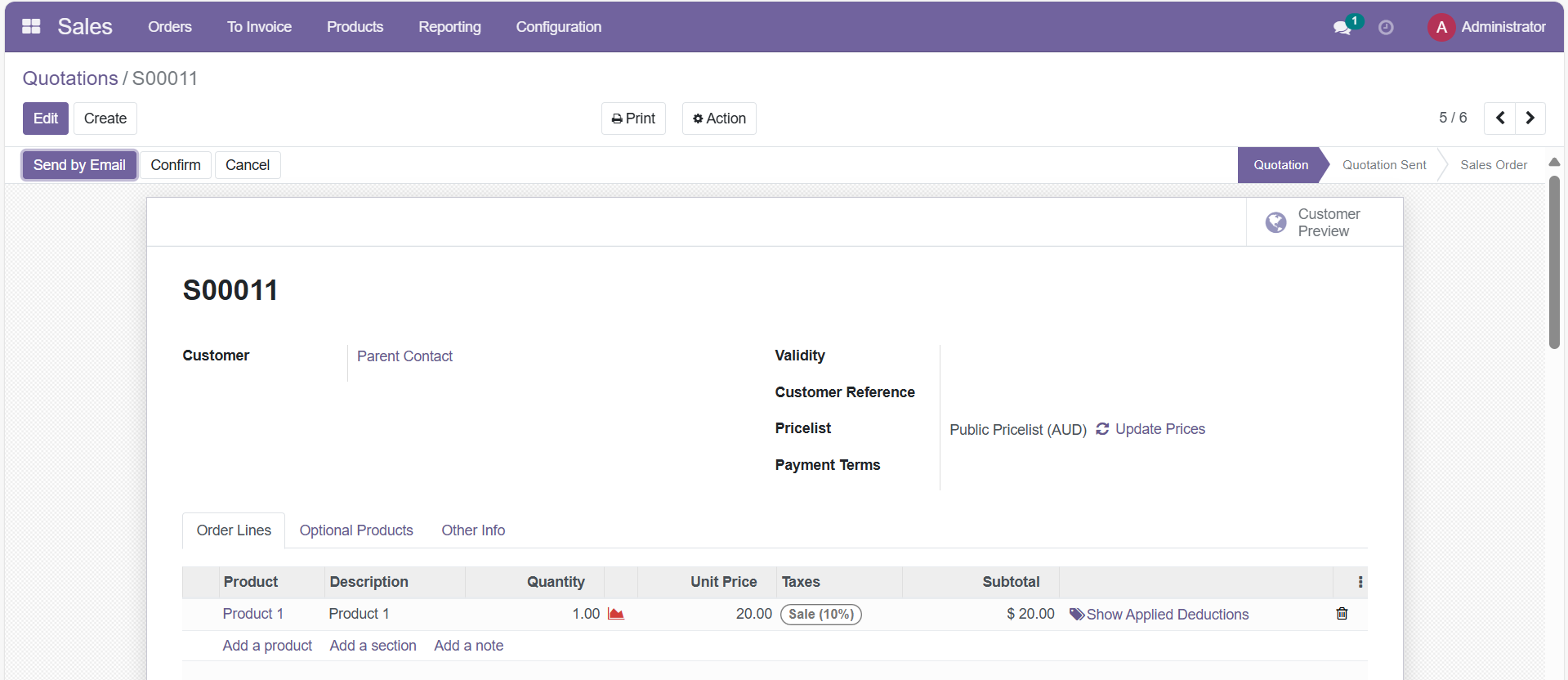

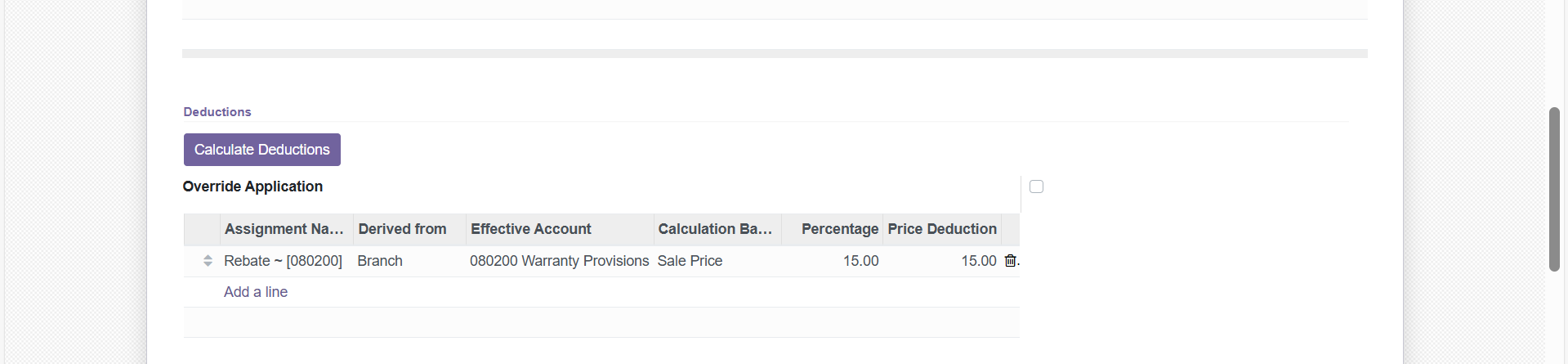

Invoice with the Parent company as customer; the deduction percentage is 30% according to the "Highest Entity Level" rule.

Lowest Entity Level

When the Lowest Entity Level rule is selected in the Deduction Definition, the deduction percentage is applied from the line in the Chart of Deductions where the percentage is set for the lowest (child/branch) company in the hierarchy.

Example:

- In the Deduction Definition, the rule is set to "Lowest Entity Level."

- The Chart of Deductions contains two entries:

30% for the Parent company;

15% for the Branch;

- When creating a Sales Order, regardless of whether the Parent or Branch company is selected in the entity hierarchy, the deduction percentage that will be applied is 15% (the value set for the Subsidiary company), since the rule requires using the percentage set at the lowest hierarchical level.

Figure 1. A 15% deduction percentage defined for the Branch company in the Chart of Deductions.

Figure 2. Invoice with the Branch company as customer; the deduction percentage is 15 % according to the "Lowest Entity Level" rule.

Figure 3.

Invoice with the Parent company as customer; the deduction percentage is still 15% according to the "Lowest Entity Level" rule.